HISTORIC

HISTORIC |

In 1994, the Law on Investment of the Kingdom

of Cambodia was passed with the aim of streamlining

the investment regime and providing generous and

competitive concessions for direct private sector

investment. This Law also created the Council

for the Development of Cambodia (CDC), a one-stop

service organization for investment in Cambodia.

The CDC, being the highest decision-making level

of the government on private (CIB) and public

(CRDB) Investments, it is directly chaired by

the prime minister. Its board is composed of all

ministers of the Royal Government of Cambodia.

The Cambodian Investment Board (CIB), has been

designated as the one-stop service of the government,

its main task is to effectively promote and facilitate

investment trough a speedy approval procedure

and very competitive incentive packages. The final

objective of this policy being to create employment,

increase national productivity and competitiveness

to achieve a sustainable socio-economic development.

GOVERNMENT POLICY

GOVERNMENT POLICY |

Cambodia is one of the poorest countries in the

region and international assistance remains a

vital component in overcoming the challenges faced

in Cambodia's development. Nevertheless, private

sector investment is becoming increasingly important

for the country as the private sector assumes

its position as the main engine for economic growth

in Cambodia. The Royal Government of Cambodia

sees private sector investment as vital to the

development of a fully democratic and prosperous

Cambodia in the years ahead.

INTEGRATION INTO REGIONAL AND WORLD ECONOMY

OF CAMBODIA

INTEGRATION INTO REGIONAL AND WORLD ECONOMY

OF CAMBODIA |

Cambodia has obtained "Generalized System

of Preferences (GSP)" and "Most Favoured

Nation (MFN)" status from its major trading

partners, including the European Union, the USA,

Japan, Canada, and Australia. Cambodia also participates

actively in the GMS development and is part of

the ASEAN since 1999. Furthermore Cambodia is

the first LDC to have integrated the World Trade

Organisation in September 2003. The remaining

objectives to achieve are the following:

· Integration to the AFTA/CEPT

· AIA

ACCESS TO SOURCES OF FINANCEMENT

ACCESS TO SOURCES OF FINANCEMENT |

Apart from facilitation and support at the national

level, attention is also being given by the government

to opening up access to international sources

of finance for private sector investment. Cambodia

is already affiliated to the IFC and MIGA. It

has also signed agreements with the ADB, providing

private sector investors with the opportunity

to obtain funding for their investment projects

from this international financing institution.

CDC A ONE STOP SERVICE WITH AN OPEN DOOR POLICY

CDC A ONE STOP SERVICE WITH AN OPEN DOOR POLICY

|

· Information and Application

· Analysis and evaluation

· Approval

· Customs duty and Tax Exemption

· Visa and Work Permits

· Company Registration

SPIRIT OF THE INVESTMENT LAW

SPIRIT OF THE INVESTMENT LAW |

· Job Creation

· Export-Oriented policy

· Free Market System

· Open and Outward-Looking Economy

· Conductive Environment

· Integration into the regional and World

Economy

Investor's treatment:

The 1994 Law on Investment provides similar treatment

to foreign and domestic investors, with the exception

of land ownership, as set forth in Cambodia's

constitution. Even in this area, the regulations

are generous, with foreign investors able to lease

land for a period of up to 70 years.

The government provides investors with a guarantee

neither to nationalize foreign-owned assets, nor

to establish price controls on goods produced

and services rendered by investors, and to grant

them the right to freely repatriate capital, interest

and other financial revenues.

Investors can set up 100% foreign-owned investment

projects and employ skilled workers from overseas,

in cases where these workers cannot be found in

the domestic labor force.

In addition, the Law on Investment and its related

Sub-Decrees grant generous incentives to investors,

especially those concerned in investment projects

geared towards exports.

Attention is also accorded to private investment

in Build-Operate-Transfer (BOT) projects, and

private investment in infrastructure, including

public utilities such as electricity, water supply

and telecommunications, a successful example of

this policy is the Phnom Penh and Siem Reap airports

realized in partnership with Vinci.

Latest investment regulations in Cambodia

2000/2003

Cambodia has approved the latest Amendment to

the law on Investment on February 23rd, 2003,

which governs all Qualified Investment Projects

(QIP) and defines procedures by which any person

establishes a Qualified Investment Project.

Our policy is concentrated on seven main points;

1- Continue to develop labor-intensive

industries, such as garment, toys and footwear.

2- Promote the development of agro-business

by strengthening legal framework for long-term

land management. The government will provide incentives

to establish factories to process agricultural

products, such as cotton, jute, sugar, palm oil,

cashew nuts, rubber, cassava and fruits.

3- Develop industries based on the utilization

of basic natural resources, mainly by processing

the existing natural resources in the country

such as fish, meat, cement production, brick and

tiles.

|

4- Promote Small and Medium Enterprises

(SME's), micro-enterprises and handicraft. The

critical issue for SME's is to provide micro financing,

streamline procedures, provide marketing services

and supply information on sectorial development.

5- Encourage the transfer of technology

and diversification of export products by promoting

the assembly of electrical and electronic appliances.

6- Establish an environment conducive

to a sustainable development in which the private

sector has been identified and entrusted as the

engine for growth. The Government will play the

role of policy maker and facilitator for an accelerated

and expended private sector involvement in the

rehabilitation and development of the country.

7- Encourage the corporate sector and

SME's as its partners in engineering growth and

to be the locomotive to pull our economy on the

right track. We aim to take maximum benefit from

economic integration and foreign trade by maintaining

the current liberal trading regime, which allows

Cambodia to integrate economically with the rest

of the world.

The adoption of these strategies is meant to

attract and promote more investment to Cambodia

and further expend international markets for Cambodian

products. More importantly, they will also speed

up the liberalization and modernization of the

national economy and increase its competitiveness

to meet regional and international standards.

ADMINISTRATIVE PROCEDURES

ADMINISTRATIVE PROCEDURES |

1 - Investment Application (Prior Approval)

All investors wishing to obtain privileges and incentives

for their investments are required to apply for

prior approval from the CDC.

Application Submission

Duly complete application must be signed and submitted

by the applicant, or by a representative of the

applicant authorized by a certified power of attorney

executed in favour of the representative, and

submitted to the CDC for review and consideration.

A certified copy of any power of attorney must

be produced at the time of the submission of the

applicant.

Requirements for Application

Application documents: A completed application

should include one set of the following documents:

1) A completed application, in the form

prescribed by the CDC and signed by a dully authorized

representative of the applicant, Whose power of

the attorney is attached;

2) A letter stating the intention of the

applicant to invest in Cambodia, with a brief

summary of the investors, the investment project,

the objectives and any special requests to the

CDC regarding investment project;

3) The constituent documents of the proposed

investment enterprise, such as the Memorandum

of association and articles of Association, in

accordance with the existing laws of Cambodia;

4) A detailed study of the economic and

technical feasibility of the investment enterprise,

including an outline of the manufacturing flow

I. Details of the qualifications of the

applicant, including:

II. Technical capacity;

III. Marketing capacity;

IV. Human resources and managerial capacity;

and financial capacity.

INVESTMENT PROMOTION AND INCENTIVES

INVESTMENT PROMOTION AND INCENTIVES |

· 20% corporate Income Tax

· Tax Holiday up to 8 years

· 5 years Loss Carried Forward

· Full Import Duty Exemption

· No Export Tax

· Free Repartition of Profit

· No Withholding Tax on Dividends

· Land Lease up to 70 year; Renewable

· No Nationalisation and Price Control

WHY TO INVEST IN CAMBODIA?

WHY TO INVEST IN CAMBODIA? |

· Competitive Investment Incentives

· Pro-Business Government

· One Stop Service - Fast-Track Investment

Approval Process

· Low Labour Cost

· Access to ASEAN and World Markets

· Preferential Trading Status

· Sound Macro-economic Environment

· Strategic Location to Serve the Mekong

6

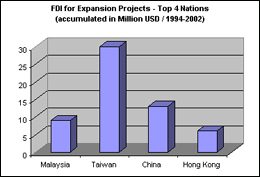

TRENDS IN FDI

TRENDS IN FDI |

Investment flows for Cambodia are attributable

to 876 projects. Net foreign investment in Cambodia

peaked in 1995 with the amount of US$ 1,909,597,365.

The average net foreign investment during 1996

- 2001 was estimated to be around 374 million

per annum. FDI has been recorded at US$ 139,549,798

in 2001, sharing 70% of the total approved projects'

investment of US$ 197,710,415 in 2001. The manufacturing

sector, in particular the textile industry, accounts

for the largest share of the overall FDI.

Even if there is a decline in FDI in Cambodia

the existing investors have managed to expand

their projects at a total project cost of approximately

US$ 90 million during the period of 2000 to 2002.

Sources of FDI

In terms of major foreign investing nation, the

top three sources are Malaysia, Taiwan, and United

States of America.

Graphic

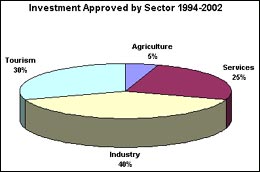

Sectors of Investment

|