VISION

STATEMENT VISION

STATEMENT |

To be the leading development financing institution

in Fiji and in the South Pacific.

CORPORATE

OBJECTIVE CORPORATE

OBJECTIVE |

To be a profitable and self sustaining financial

institution

MISSION

STATEMENT MISSION

STATEMENT

|

Provide finance, financial and advisory services

to assist in the economic development of Fiji

and in particular in the development of agriculture,

commerce and industry.

HISTORY HISTORY

|

Development banking in Fiji dates back to December

1951 with the establishment of the Agricultural

and Industrial Loans Board (AILB). The economy

at that time, was predominantly an agricultural

one and the small farmer (many of whom were former

indentured labourers) was recognised as a key

factor to development. The need by the farmers

for finance saw the setting up of the AILB in

July 1963. Lending increased intensively where

it reached a stage that it could no longer operate

effectively. On 30th June 1967 the AILB ceased

to exist. It was here that all assets and liabilities

of the AILB were transferred to the Fiji Development

Bank (FDB), which commenced operations the following

day, 1st July 1967.

FIJI DEVELOPMENT

BANK ACT FIJI DEVELOPMENT

BANK ACT |

Under the Fiji Development Bank Act, the FDB

received wider powers to facilitate and stimulate

the development of natural resource in Fiji. Furthermore,

economic development of the rural and agricultural

sectors of the economy was to be given special

consideration with particular emphasis on ventures

that created jobs, increased exports, utilized

local raw materials and substituted local products

for imported items. With these as its core vision

and mission, the FDB began its long journey, developing

the Fiji economy, and improving the welfare of

the people in Fiji.

AREAS OF

ASSISTANCE AREAS OF

ASSISTANCE |

FDB has assisted the country through its lending

in the following areas:

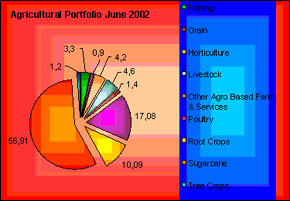

AGRICULTURAL SECTOR

The agricultural sector particularly sugar cane

farming.

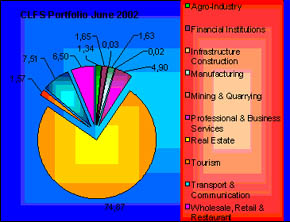

COMMERCIAL LOANS TO FIJIANS SCHEME

In 1975 introduced a soft loan scheme for indigenous

Fijians. The scheme, known as the Commercial Loans

to Fijians Scheme (CLFS) was an initiative by

Government to encourage indigenous Fijians to

enter the fields of commerce.

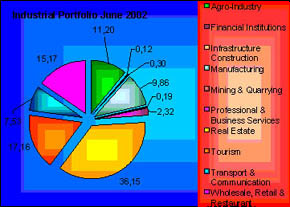

INDUSTRIAL AND COMERCIAL LENDING

In the early 80's, the Bank diversified to industrial

and commercial lending shifting from its traditional

agricultural focus.

NEW ZEALAND SMALL LOAN SCHEME (NZSLS)

April 1989 saw the establishment of the NZSLS under

a Bi-lateral Aid Programme provided by the New Zealand

Government targeting the Development of Women and

Rural People of Fiji. |

SHAREHOLDING IN COMMERCIAL VENTURES (EQUITY

SCHEME)

This equity scheme aimed at assisting new projects

in to make equity investments in projects of national

importance, to stimulate growth and development

in the country. The shares are acquired by the

Bank, and are eventually sold to existing shareholders

or to the public once the projects are established

and operating profitably.

LEASE FINANCE OPERATION

In November 1994, in its Product Diversification

for Greater Commercial Development strategy, the

Lease Finance operation was launched.

THE WORKING CAPITAL FACILITY

Working Capital to corporate clients, Bill Discounting,

and Funding for Imports was introduced in January

1996.

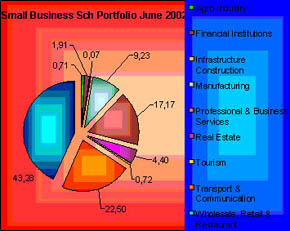

SMALL BUSINESS SCHEME (SBS)

In October 2000, its latest soft loan scheme

for communities other than the indigenous community

known as the SBS was introduced.

LOANS MANAGEMENT SYSTEM (LMS)

Keeping abreast of latest computer technology,

a newly designed in-house LMS was introduced in

January 2000.

SEED CAPITAL REVOLVING FUND (SCARF)

April 2002 saw the implementation of the SCARF.

This aimed at encouraging indigenous participation

in the areas of Eco-tourism, fishing and forestry

sectors.

TERM DEPOSITS

Furthermore, the Bank has made a submission to

the Reserve Bank of Fiji to accept term deposits

from corporate clients and the public. This would

ease the Bank's high cost of borrowing and would

further contribute to the diversification of the

banking market.

SUCCESS

STORY SUCCESS

STORY |

THE FIRST FOR FIJI

Soqoiwasa Marketing, at first glance, is just

like any other shoe-manufacturing factory. But

on closer scrutiny, it is peculiar and distinguished.

This factory is the first Indigenous Fijian-owned

shoe venture of its kind.

Proprietor of the business, Mr Inoke Soqoiwasa,

had long planned to establish his own business,

as he wanted to provide a secure and stable future

for his young family. His 8-years of work experience

as a factory manager at Footwear Exporters Limited

factory was sufficient background to initiate

the operations of Soqoiwasa Marketing. With the

financial backing of FDB, his dream was finally

fulfilled with the opening of his outlet in the

capital, Suva in 1995.

Spearheading the operations, entrepreneur Soqoiwasa

initially adopted a niche marketing strategy,

focusing on specially designed sandals for school

students. Targeting the secondary school markets

such as Queen Victoria, Adi Cakobau, Sila Central

and Ballantine Memorial Schools, Soqoiwasa Marketing

has enjoyed their loyal services since 1996.

In 1997, the business introduced into the market

their new brand of sandals "Lako Tu"

to differentiate them from other suppliers and

to develop into a household name in Fiji. This

product differentiation has attracted demand from

renowned local high schools like Ratu Kadavulevu

School, Levuka Public School and Delana Methodist

School.

Growth has been at a steady rate and is expected

to expand progressively. Employees have also increased

to 40 compared to 4 when the business was established.

To anticipate the demand and subsequent business

expansion, Mr Soqoiwasa approached FDB for further

funding assistance in 2001.

When interviewed, Mr. Soqoiwasa said "

I am very grateful to the Bank for its support

and I will always know that I can rely on them

for any further assistance".

Even though Soqoiwasa Marketing faces stiff competition

from both local and overseas suppliers, Mr. Soqoiwasa

believes he has a competitive edge in terms of

price and quality. His determination and competency,

has seen him surviving the storm this far.

In this 21st century, the FDB continues to review

its services in line with changing customer demands

and global trends. For further information on its

products and services, go to www.fijidevelopmentbank.com.

|