OUR VISION OUR VISION |

Leading Fiji to Economic Success

OUR MISSION OUR MISSION |

· Enhance our role in the development of

the economy

· Provide proactive and sound advice to Government

· Develop an internationally reputable financial

system

· Conduct monetary policy to foster economic

growth

· Disseminate timely and quality information

· Recruit, develop and retain a professional

team

OUR VALUES OUR VALUES |

PROFESSIONALISM … in the execution of our

duties

RESPECT ….for our colleagues

INTEGRITY … in our dealings

DYNAMIC…In addressing our customers' needs

EXCELLENCE…in everything

SUPERVISORY

RESPONSIBILITIES SUPERVISORY

RESPONSIBILITIES |

The functions, powers, and responsibilities of the

Reserve Bank of Fiji (RBF) are specified in the

Reserve Bank of Fiji Act, 1983, Rev 1985.

"The principal purposes of the Reserve Bank

as stated in Part 11, section 4 of the RBF Act

are as follows:-

· to regulate the issues of currency,

and the supply, availability and international

exchange of money;

· to promote monetary stability;

· to promote a sound financial structure;

and

· to foster credit and exchange conditions

conducive to the orderly and balanced economic development

of the country."

The

promotion of a sound market-based financial system

is the responsibility of the Financial Institutions

Department. The RBF is the supervisory authority

for commercial banks, credit institutions and the

insurance industry in Fiji. The

promotion of a sound market-based financial system

is the responsibility of the Financial Institutions

Department. The RBF is the supervisory authority

for commercial banks, credit institutions and the

insurance industry in Fiji.

THE OBJECTIVES

OF SUPERVISING THE FINANCIAL SYSTEM THE OBJECTIVES

OF SUPERVISING THE FINANCIAL SYSTEM |

In carrying out its role in "promoting a sound

financial structure," one would presume that

the Reserve Bank of Fiji supervises all finance

and banking activities in Fiji. However, this is

not so.

The Reserve Bank of Fiji focuses only on institutions

that accept deposits from the public and invests

these funds either in loans or investments; currently

only banks and credit institutions. In addition,

the Reserve Bank of Fiji also supervises the insurance

industry comprising insurance companies, brokers

and agents.

While carrying out its supervisory functions,

the Reserve Bank focuses on issues of prudential

concern. Other authorities, including the Department

of Fair Trading, of the Ministry of Commerce,

Business Development and Investment look at consumer

issues.

In supervising the financial system, the Reserve

Bank aims:

· to protect the interest of depositors,

creditors and policy holders of banking and insurance

businesses by setting, promoting, monitoring and

enforcing high standards of integrity and financial

soundness of the institutions it regulates.

· to promote efficient financial system

by promoting consumers' and financial institutions'

confidence in its strength and integrity; and

by ensuring that failure of financial institutions

do not undermine the overall stability and soundness

of the financial system.

The Reserve Bank will pursue these aims in an

efficient way and will:

· acknowledge customers' responsibilities

for their own decisions, while aiming to ensure

that they are not exposed to risks that they are

reasonably be expected to assume; and

· aim to ensure that the costs of regulating

the financial system are proportionate to the

benefits derived from it.

The Reserve Bank consults closely with participants

in the banking and insurance industries and, where

necessary, with other regulatory authorities on

matters of mutual interest affecting our financial

system.

STRUCTURE

OF THE FINANCIAL INSTITUTIONS DEPARTMENT STRUCTURE

OF THE FINANCIAL INSTITUTIONS DEPARTMENT |

The

Financial Institutions Department's major objective

is to maintain a sound market-based financial system

through the prudential supervision of licensed financial

institutions. The Department is also tasked with

ensuring the sound operation of insurance companies

and protecting the interests of policy holders.

The Department has four Units: the Policy &

Licensing Unit, 2 Banking Supervision Unit. The

Financial Institutions Department's major objective

is to maintain a sound market-based financial system

through the prudential supervision of licensed financial

institutions. The Department is also tasked with

ensuring the sound operation of insurance companies

and protecting the interests of policy holders.

The Department has four Units: the Policy &

Licensing Unit, 2 Banking Supervision Unit.

The objectives of the Policy and Licensing Unit

are to develop and review policies relating to

the supervision of the financial and payments

system structure and their impact on supervision,

monitor international developments and their impact

on supervision, review new registration and licensing

applications, including applications for renewal

of licenses.

The objectives of the Banking Supervision Units

are to monitor the performances of institutions

and to ensure their adherence to prudential policies

and regulations.

The objectives of the Insurance Supervision unit

are to monitor the performance of institutions

licensed under the Insurance Act through off-site

supervision of the institutions and to ensure

adherence by insurance agents, brokers and companies

to statutory requirements and industry codes of

practice.

RBF APPROACH

TO SUPERVISING THE FINANCIAL SYSTEM RBF APPROACH

TO SUPERVISING THE FINANCIAL SYSTEM |

In addition to the powers to supervise activities

of banks and credit institutions provided for

under the Banking Act, the Reserve Bank with effect

from 1st January 1999, acquired the statutory

and licensing functions formerly exercised by

the Office of the Commissioner of Insurance. These

functions, which were performed under the Insurance

Act, 1976 are now contained in the Insurance Act,

1998.

In line with this change the Financial Institutions

Department 's interest in these areas has been

expanded to include the protection of the interests

of policy holders of insurance companies.

In developing policies to supervise the financial

system, the Reserve Bank aims at working towards

meeting international standards. Recently, the

Reserve Bank has developed a mission statement

which is more proactive and aims at making our

financial system has an intention of developing

an internationally reputable financial system.

BANK AND CREDIT INSTITUTIONS

Under the Banking Act, the Reserve Bank licenses

and supervises those institutions that accept

deposits from the public. These include commercial

banks and the credit institutions.

Consistent with the Act, the Reserve Bank requires

that financial institutions follow certain prescribed

rules that include adhering to prudential policies

and guidelines. These rules are based on and are

in accordance with the practices recommended for

adoption internationally by the Switzerland-based

Basle Committee on Banking Supervision.

INSURANCE COMPANIES

The Reserve Bank's role under the Insurance Act,

1998 is to formulate "standards governing

the conduct of insurance business and insurance

broking business" and to supervise the "conduct

of agents, brokers and insurer in the Fiji Islands".

The insurance industry in Fiji includes life

insurance companies, general insurance companies

and brokers. There are also hundreds of individual

or corporate agents who have been licensed to

sell insurance products for specific insurance

companies.

The

Reserve Bank's approach to insurance supervision

include: The

Reserve Bank's approach to insurance supervision

include:

· strengthening of the licensing requirements

for new entrants into the industry;

· ensuring that insurers meet minimum solvency

requirements;

· setting regulations on how the funds

of an insurer or broker may be invested; and

· evaluating the reinsurance arrangements

of insurers to enusre that they are adequate to

cover all risks.

Supervision is mainly done off-site through the

analysis of statutory returns and other reports

submitted by insurers and brokers to the Reserve

Bank of Fiji.

In recent years, the Reserve Bank has been working

on developing these guidelines, the Reserve Bank

looks at practices recommended for adoption internationally

by the International Association of Insurance

Supervises.

|

RBF QUARTERLY

REVIEW 2002 RBF QUARTERLY

REVIEW 2002 |

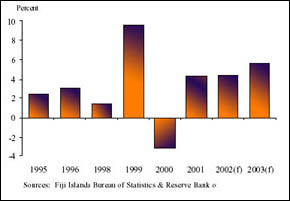

GROSS DOMESTIC PRODUCT

The forecast for economic growth in 2002 remained

at 4.4 percent, unchanged from the September quarter.

Most sectors performed well, with the tourism

and wholesale and retail sectors anticipated to

have led growth in 2002.

GDP GROWTH RATE

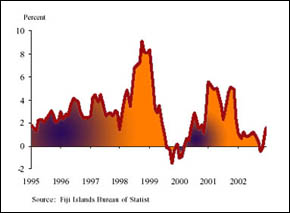

INFLATION

In the year to December, inflation was 1.6 percent,

up from -0.1 percent recorded in November. Over

the month, consumer prices rose by 1.5 percent,

mainly reflecting higher prices of food, miscellaneous

items, housing and transport. The food category

recorded the most significant increase, and was

mainly underpinned by a rise in prices of volatile

food items such as vegetables and root crops.

The underlying measure of inflation, the trimmed

mean, was negligible at 0.03 percent in December.

In 2003 inflation is expected to pick up. Domestically,

price pressures are expected to rise, reflecting

the increase in the VAT rate by 2.5 percent. However,

as the rise in VAT is a one-off increase in prices,

its effect on inflation is likely to be temporary

and expected to erode by 2004. externally, global

economic conditions remain relatively subdued,

which should mitigate any inflationary pressures

coming through from our major trading partners.

However, risks to this assessment include the

possibility of a war against Iraq, concerns over

North Korea's nuclear programme and the industrial

oil strike in Venezuela which could lead to higher

oil prices. Barring any international shocks,

however, the year-end inflation outlook for 2003

is for moderate inflation.

THE EXTERNAL SECTOR

On the external front, accrual trade data indicate

that cumulative to November, merchandise exports

declined by almost 7 percent, from the corresponding

period last year. This was largely due to declines

in receipts from garments, fish, textiles and

gold, which more than offset increases in earnings

from sugar, mineral water and fruit & vegetables.

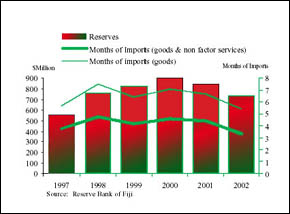

GROSS FOREIGN RESERVES

Consistent with the relatively strong domestic

demand, merchandise imports grew by more than

3 percent in the year to November, compared with

the same period in 2001. This was largely due

to higher import payments for investment and consumption

goods, which more than offset a decline in payments

for intermediate goods. The rise in investment

goods was due to an increase in imports of machinery

& transport equipment and chemicals, while

food, beverages & tobacco contributed to the

rise in payments of consumption goods over the

period. Foreign reserves at the end of 2002 were

around $730 million, sufficient to cover 3.4 months

of import payments of goods and non-factor services

or 5.4 months of imports of goods.

DOMESTIC FINANCIAL CONDITIONS

Money Markets

The demand for inter-bank funds in the December

quarter rose significantly, when compared with

the previous quarter, as a result of withdrawals

of maturing term deposits by institutional investors.

Turnover in the inter-bank market during the review

period totalled $133 million, higher than the

$74 million recorded in the September quarter.

Despite the increase in activity in the inter-bank

market, the weighted average inter-bank rate remained

unchanged from the previous quarter, at 0.84 percent.

The Reserve Bank kept its monetary policy stance

unchanged during the December quarter, maintaining

the Bank's announced target policy indicator rate

on the 91-day RBF Notes at 1.25 percent.

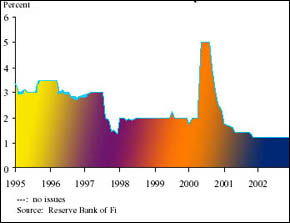

RBF NOTES - 91 DAY YIELDS

During the December quarter, there were 48 issues

of RBF Notes totalling $1,408 million. The weighted

average yields on the 14-day, 28-day and 56-day

maturities fell by 16 basis points, 4 basis points

and 3 basis points to 0.63 percent, 0.83 percent

and 1.19 percent, respectively. During the same

period, there were 10 issues of Treasury bills

amounting to $170 million. The weighted average

yields on all Treasury bill maturities fell over

the quarter. In the review period, there were

4 issues of promissory notes in total, by the

Public Rental Board, FSC and the Fiji Development

Bank (FDB), totalling around $21 million. Weighted

average yields ranged from 1.64 percent to 3.06

percent, compared with 1.87 percent to 4.15 percent,

respectively, in the previous quarter.

Capital Markets

During the December quarter, Government issued

$79 million worth of bonds, with maturities ranging

from 3 years to 15 years. The weighted average

bond yields ranged from 2.95 percent to 6.19 percent.

During the same period, the FDB and Housing Authority

issued bonds totalling $49 million with maturities

ranging from 3 to 10 years. Weighted average yields

ranged from 2.92 percent to 5.83 percent.

Foreign Exchange Markets

During the December quarter, the Fiji dollar

weakened against the NZ dollar and the Euro, but

gained against the US and Australian dollars and

the Yen. Fiji's Nominal Effective Exchange Rate

Index, which reflects aggregate exchange rate

movements between the Fiji dollar and the major

trading partner currencies, fell marginally over

the year to December, indicating a slight depreciation

of the Fiji dollar against the basket of currencies.

The Real Effective Exchange Rate Index, a measure

of Fiji's international competitiveness, fell

over the year to December, reflecting an improvement

in the country's international competitiveness.

The favourable outturn was the result of lower

domestic inflation outcomes relative to our major

trading partner countries.

EXCHANGE RATES

Financial Intermediaries

Commercial Bank interest rates fell further in

the year to November 2002, reflecting the Reserve

Bank's continuing accommodative monetary policy

stance. Interest rates are currently at all-time

lows. In the year to November 2002, the weighted

average lending rate on outstanding loans &

advances fell further, by 37 basis points, to

7.84 percent.

INTEREST RATES

The time deposit rate declined by 29 basis points

to 2.14 percent, while the savings deposit rate

fell by 21 basis points to 0.56 percent. Movements

in money and credit aggregates improved further

in the year to November 2002. Broad money rose by

8.44 percent in the year to November 2002, due to

increases in demand deposits (21.2 percent), currency

in circulation (9.4 percent) and savings deposits

(5.3 percent). On an annual basis, total credit

to the private sector rose by 2.9 percent in November,

driven largely by higher commercial bank lending

to the wholesale, retail, hotels & restaurants,

manufacturing, and building & construction sectors,

as well as to private individuals. During the same

period, commercial bank lending to the electricity,

gas & water, real estate, transport & storage

and agriculture sectors was lower.

COMMERCIAL

BANKS LOANS AND ADVANCES

In the year to November 2002, total lending by

Licensed Credit Institutions (LCIs)2 rose by 2.9

percent. While lending by LCIs to the real estate,

building & construction, transport & storage

and other sectors, as well as to private individuals,

was higher in the quarter, lending declined to

the manufacturing, mining & quarrying, public

enterprises, agriculture and professional &

business services sectors.

In the year to November 2002, the weighted average

lending rate on outstanding loans by LCIs fell

by 21 basis points to 14.54 percent. For Non Bank

Financial Institutions, total investment by the

FNPF rose by 2.32 percent in the year to September

2002, following an expansion of 5.49 percent in

the June quarter. The growth was mainly due to

higher holdings of government bonds. In the year

to September 2002, FDB's lending declined by 9.10

percent mainly due to lower lending to the agriculture,

wholesale & retail and real estate sectors,

as well as to private individuals.

Table

1

Table

2

|