Telecommunications

in Cambodia Telecommunications

in Cambodia |

Years of civil war both destroyed most of the

existing fixed network and prevented the construction

of new lines. At the end of 1992, the year mobile

cellular was introduced in Cambodia, there were

only a little over 4,000 fixed lines for a population

of some 9.3 million. A year later, mobile had

already surpassed the fixed lines. Another contributing

factor to mobile success was that the government

liberalized the market early on, allowing both

private investment and competition. As the Minister

of Post & Telecommunications, H.E. So Khun

explains: Even though it was very hard to

attract foreign investors towards Cambodia, the

telecommunications sector in this country had

two points of interest. First we put unto place

a very liberal and open market and second there

were plenty of donations from international organizations

to help develop the sector. The private sector

is mainly investing into mobile phone services".

Cambodia was the first country in the world where

mobile telephone subscribers passed fixed ones

- way back in 1993. Cambodia began the millennium

with more than four out of five telephone subscribers

using a wireless phone, the highest ratio in the

world. Thanks to mobile, Cambodia's teledensity

- telephone subscribers per 100 inhabitants -

reached one in 2000, a significant achievement

for a Least Developed Country (LDC). While mobile

has contributed to the bulk of Cambodia's telecommunication

progress over the last decade, wireless fixed

lines have also helped and accounted for five

percent of all telephone subscribers at the beginning

of 2001.

Current

Situation Current

Situation |

development. Perhaps the biggest factor contributing

to wireless success is that there just never were

many fixed lines to begin with. Today,

Mobitel , a GSM mobile operator, is the largest

telecom network operator in the country with more

than 120'000 subscribers at the beginning of 2003,

and the company is planning to expand further

as Oknha Kieth Tieng, Vice-Chairman of the Royal

Group (from which Mobitel is a subsidiary) explains:

"In terms of growth we are expecting an increase

of 10,000 new subscribers every month. We have

always been the pioneers in this country and we

will keep on being leaders by a constant innovation.

We were the first to bring in a GSM system in

Cambodia; we also were the first to introduce

a cell card (…) This is the only way to win

the communications battle, always being one step

ahead, and of course provide the best service".

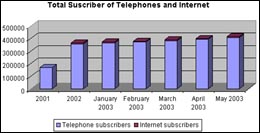

This tendency to growth can be confirmed thanks

to the statistics of The

Ministry of Posts and Telecommunications of Cambodia

(MPTC) where an steady increase of the subscriptions

can be observed throughout the beginning of 2003.

There are three digital and two analogue mobile

operators, all with foreign investors. Two additional

digital mobile licenses have been awarded but

have not yet started operating. Another success

factor has been prepaid, with over 90 percent

of mobile subscribers opting for this payment

method. With a per capita GDP of only US$260,

most Cambodians either could not afford or would

not qualify for a subscription telecommunication

service. Prepaid cards with denominations as low

as US$5, and a used handset available for as little

as US$20 make mobile telecommunications much more

accessible. Prepaid is also attractive from an

operator's perspective because it eliminates the

risk of subscriber default. Another contributing

factor to mobile growth is billing in US dollars

(use of the US dollar is widespread in Cambodia),

which reduces the investor's exchange rate risk.

While wireless communications have helped Cambodia

achieve a minimal level of communications, it

has also created its fair share of problems. This

includes a confusing mix of government shareholdings

and agreements; an interconnection maze; and an

over-reliance on mobile network service provision

to the detriment of the fixed line network.

The Ministry of Posts and Telecommunications of

Cambodia (MPTC) is the industry policy-maker and

regulator. In addition, it is involved in some

way in every telecommunication network in the

country either as a provider or joint venture

partner. But this is soon going to change as the

H.E.So Khun is planning to create an independent

body who will start regulating the industry and

is also considering all the options for privatization.

"The first step is to set up the Telecommunications

Authority (TCA) in order to be able to prepare

a Telecommunications Law. We have drafted some

suggestions on how this regulator should have

to function and discussed it for a long time with

the Ministry of Finance how to set it up. The

privatization is needed, but we don't want to

go too quickly to avoid problems".

It has managed this feat without investing much

of its own money. Most of the fixed network has

been provided through bi-lateral assistance, while

the mobile network has been constructed with foreign

investment. According to the Council for the Development

of Cambodia, private capital totaling US$131 million

was invested in the telecommunication sector during

the period 1994-1999.

The only network the MPTC owns outright is the

local exchange in Phnom Penh. The Japanese Government

largely funded extensions during the 1990s to

the Phnom Penh network (US$ 40 million in two

projects, US$ two million contributed by Cambodia).

The first extension began in December 1996 and

was completed in March 1997 providing 6'800 lines

and is to be expanded to 50'000 lines by 2007.

In the year 2000, the MPTC also began installing

fixed lines outside Phnom Penh by putting local

exchanges in eight provinces.

One side effect of practically starting from

scratch is that all local telephone lines are

connected to digital exchanges. Although over

the years consultants have presented several proposals

advocating the corporatization of the telecommunication

arm of the Ministry and the creation of a "Telecom

Cambodia", no action has been taken. Instead,

MPTC's revenues continue to be reported as a part

of overall government revenues, and its profits

absorbed by the government for use elsewhere.

|

This has adversely affected the MPTC's ability

to expand the fixed network. As a result, there

is a de facto policy of allowing private investment

in partnership with the MPTC to expand telecommunications.

Most of this investment has flowed into the mobile

sector but has also included Wireless Local Loop

(WLL), fixed lines in the provinces and international

gateways.

While this policy has contributed to telecommunication

development, it is marked by a lack of transparency.

For example, there is no clear picture of licensing

or policy and timetable for telecommunication

liberalization. Rather, restrictions on market

entry are generally a function of various contracts

signed between the MPTC and the operators.

Prefix

city Prefix

city |

For a country of its size and income, Cambodia

has one of the most crowded telecom markets in

the world with six operators running a total of

eight fixed and mobile networks. These numbers

rather than names have assigned different prefixes

to the networks that are often referred to. There

is no number portability, for either fixed or

mobile. Cambodia has a Calling Party Pays system.

All networks are required to interconnect and

there is a central interconnection point at the

MPTC in Phnom Penh.

The interconnection charge established by the

MPTC has been revised several times. While the

MPTC had authorized negotiations between operators

to establish cost-based interconnection charges

the Ministry abruptly changed its mind in mid-2001.

It announced that it would adopt Sender Keeps

All (SKA) and thus no longer make interconnection

payments. This reversal was, no doubt, triggered

by a traffic imbalance from fixed to mobile calls

of between 14-20:1.

Mobile operators, who receive more fixed calls

than they send out, will be adversely affected

by this change. Some operators have suggested

that if SKA were fully implemented, they would

have to reconsider their investment strategy due

to the end of revenues from incoming calls.

International

cash cow International

cash cow |

Telstra of Australia opened Cambodia to the world

when it installed the first international gateway

in 1990. This was done as a so-called 10-year

Business Cooperation Contract (BCC) with the MPTC.

Telstra received 51 percent of the revenue, and

the MPTC the remainder. The BCC expired in 2000

and the gateway is now fully owned by the MPTC.

Millicom launched the country's second international

gateway in November 2000 through its Tele2 subsidiary.

This arrangement is structured as a joint venture

between the MPTC, Millicom and the Royal Group.

The license is valid for 25 years. It is not believed

that any additional international gateways will

be awarded in the near future.

The MPTC earns 85 percent of its revenue from

international tariffs in the world and the fixed

network is so limited. The international tariff

structure is straightforward. There are three

bands and a weekday and weekend rate. Mobile operators

charge the MPTC rate in addition to the mobile

per minute call charge. Access to direct international

calling from fixed lines requires the payment

of a deposit of currently US$150 for the MPTC

network and US$200 for Camintel's

network.

Because of the high cost of international calls,

users are turning to other methods for communicating

abroad. First, many people rely on incoming international

calls with the ratio of incoming to outgoing 3:1

(29 million minutes of incoming international

calls in 2000 compared to 9.6 million outgoing).

Second, despite its illegality, there appears

to be growing use of Voice over Internet Protocol

(VoIP) with a number of Internet cafés

openly advertising it. Due to this situation,

the MPTC is looking at the possibilities to open

this market. "So far they are in the trial

period, from the university of Phnom Penh you

can already use it and if everything works out

fine, the whole system will be launched this year

and will be a protected market for 7 years",

said the Minister

of Posts & Telecommunications.

Internet Internet |

The penetration of the Internet in Cambodia has

been as skyrocketing as the implementation of

mobile phones, as Under Secretary of State, H.E.

Koy Kim Sea, who is also in charge of Camnet,

explains: "Lately the growth of Internet

has been slowed down due to the lack of a proper

telecommunications infrastructure in the country.

The mobile telephony has developed at a greater

pace than the ground lines making the penetration

of Internet to the rural areas more difficult".

Nevertheless, next to Camnet, national Internet

access provider, there are another 4 ISP's active

in the country and other licenses have been granted

although they are not yet active.

In order to see the IT sector develop the government

has created a new institution responding directly

to the Prime Minister Hun Sen, in words of his

Secretary General, Mr. Leewood Phu, the NiDA (National

Information Communications Technology Development

Authority): "NiDA's

task is to formulate an IT promotion policy for

the short, medium and long term. The purpose of

that is again in response to the evolution in

ASEAN and to the whole world as well". The

Authority is also charged with the formulation

of an ICT Master Plan, with one of its main objectives

the connection of all layers of the government

to the Internet to improve the quality of service

to bring the government closer to the people and

vice versa.

Since the creation of the Authority three years

back, the evolution has been remarkable. It started

as a three men team and currently counts with

106 employees. "Before the formation of NiDA

the connection to the Internet was considered

a luxury for the people of Cambodia. Only NGO's

or high government officials had access to it.

After the formation of NiDA, the price dropped

and Internet café's sprung up. A survey

conducted early this year showed that in Phnom

Penh only, there were almost two hundred Internet

café's with a very cheap access to Internet".

Conclusion Conclusion |

The telecom operation arm of the Ministry

of Posts and Telecommunications (MPTC) would

be separated out into a state enterprise called

Telecom Cambodia (TC), which would respond to

the market trends in competition. A Draft of the

Sub-Decree on this subject has been made and expects

its finalization, possibly, in the current mandate.

Telephone calls in Cambodia are generally among

the highest in the world. The official price of

international telephone calls was set up and published

with yearly steady reduction and with up to 20

percent discount on Week-End, based on the international

accounting rate bilaterally agreed up on a specific

schedule. Prices for calls to neighboring countries

then were decreased throughout the years as follows:

Graphic

(Click here)

This decrease would be gradually applied for

the year 2003. There is no possibility of the

MPTC issuing another gateway license based on

the current laws and traffic demand. However,

these are subject to change depending on the company

expressing interest. There are about 313,160 mobile

users in the country. It is a very prosperous

sector as the operators enjoy the fair playing

field fostered by MPTC. They compete with each

other freely without any impositions of price

restriction. However, it is a common phenomenon

for congestion to plague the networks because

of over-capacity and insufficient equipment to

meet demand, especially during peak hours. Investment

has been quite stagnant in this aspect because

of costs involved (investments normally get investment

incentives such as tax free imports) and the high

costs of securing expansion investments.

|