Electrifying

the country Electrifying

the country |

Cambodia's infrastructure, which was almost completely

destroyed after more than 20 years of warfare,

civil strife and neglect, is slowly being restored.

Cambodia's public utilities are unreliable, expensive,

and cover only the major cities. There is tremendous

demand in Cambodia for diesel generators for use

as back up power, on-site industrial power plants,

and power generation in rural areas not served

by public utilities. Natural gas is not currently

economical in Cambodia.

Electricity grid exists, and only 12% of the

total population has access to electricity, with

only about 7 percent of the rural population having

access to a reliable electricity supply. Another

45 percent has less dependable battery-powered

electricity.

In Cambodia, electricity is generated in 22 isolated

systems, mostly from diesel generators. In 2000,

the total installed capacity of electricity generation

in Cambodia was 145 MW. As a result of the small

size of generation units (300 kW to 5 MW unit

size), dependence on oil-based generation, and

large distribution losses, the unit cost of electricity

in Cambodia is among the highest in the region.

Electricity sales increased from 311,508 MWH in

1999 to 355,790 MWH in 2000. Demand for power

in Cambodia as estimated at 125 MW in 1998 and

is expected to increase to 800 MW by 2016.

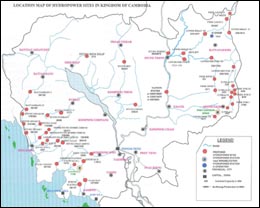

The minister's inviting message is clear "In

the power sector we would like to invite investors

to come develop our hydropower resources. This

is a very good opportunity, once we have linked

our network with the neighboring countries, we

can even sell the excess of power to them. The

GMS countries have signed the Inter-governmental

Agreement for Power Trade. H.E.

Ith Praing, Secretary of State at the Ministry

of Industry, Energy and Mines, concludes.

Cambodia is currently buying electricity for Poipet

town from Anco, an international engineering and

energy company that possess a transformer just

across the border in Sa Kaeo, Thailand. The project

cost $3 million, and also plans to supply Siem

Reap and Battambang in projects that cost upward

of $13 million. Thai company EGCO announced in

2001 that it would also bid on selling electricity

to these same Cambodian towns beginning in 2003.

Early last year, National Thai Electricity Company

EGAT finalized a Contract to supply 30MW of electricity

to western Cambodia.

Similarly, Cambodia signed agreements in 1999

and 2000 to buy electricity from Vietnam, a five-year,

$20 million venture that was supposed to begin

in 2001 with partial funding from the World Bank.

To supply the energy, Vietnam was to build a series

of transformers and power lines the stretched

from Can Tho in the Mekong Delta west into Takeo,

Cambodia. However, the project has yet to be completed.

Other cooperation with Vietnam are: (i) the importation

of power to supply communities close to the border

in the provinces of Svay Rieng, Takeo, Prey Veng,

Kandal and Kampot and (ii) a Feasibility Study

on the Interconnection between the two national

grids at high voltage.

The power

sector strategy The power

sector strategy |

The Royal Government of Cambodia formulated policy

to provide adequate energy throughout Cambodia

at reasonable and affordable price and is determined

to take accelerated action and initiative in making

available the energy to the disadvantaged group

of population. In order to achieve these objectives

the Royal Government has developed a long-term

(1999-2016) Power Sector Strategy. According to

Dr. Ty Norin, Chairman of the recently created

Electricity

Authority of Cambodia (EAC) (www.eac.gov.kh),

"The main problem in Cambodia is the cost

of power generation, (…) we are concentrating

our efforts into helping to bring down the generation

costs in order to achieve lower electricity costs.

(…) we will interconnect the system, then

we will increase the amount of users and finally

we will propose investment possibilities".

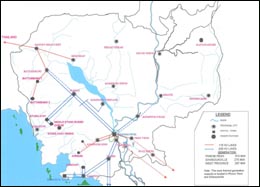

With regard to electricity generation planning,

the government envisions the establishment of

a gas power plant in Sihanoukville and hydropower

projects located in the western portion of Cambodia.

The government also plans to develop a national

grid linking the larger generating units to population

centres, starting initially in the southern portion

of the country (Phnom Penh to the Vietnam border,

Takeo, Kampot and Sihanoukville), and later expanding

to the northern region, including Banteay Mean

Chay, Siem Reap and Battambang. The government

has also initiated a rural electrification program

that includes the development of renewable energy

sources.

Energy

Development Plan Energy

Development Plan |

As concerns the Rural Electrification Strategy

the Minister of Industry, Energy and Mines precises

that " The electricity development program

includes grid extension to the areas that are

close to an existing grid and the development

of stand-alone systems with diesel generators

for villages and small communities and the development

of renewable energy sources with projects like

the micro-hydro in the northeastern or western

part of the country, and the solar power energy".

The minister also explains how the creation of

the Rural Electrification Fund (REF) will "subsidize

one part of the rural electrification investment;

the other sources of financing are:

1) longer term loan from local commercial bank

designated by the World Bank and (2) self equity".

Plans for Cambodia's first independent power

production project, scheduled to provide another

60 megawatts of electrical power to the city,

are nearing completion.

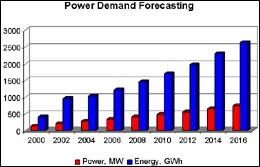

According to the Cambodia Power Sector Strategy

(1999-2016) developed by the Ministry of Industry,

Mines, and Energy (MIME), annual electricity demand

in Cambodia is projected to rise from 522GWh in

1998 to 2,634 GWh in 2016. To meet this demand,

the government plans to develop $1 billion worth

of hydro, gas turbine thermal, and combined cycle

base load thermal generating plants in Phnom Penh,

Sihanoukville, Battambang, and other cities from

2000 to 2010. The Cambodian government also plans

to build a nation-wide transmission system during

the same period.

Though Power supply to the city of Phnom Penh

has improved dramatically since 1993, and approximately

50 megawatts of power were added to serve the

city during 1995 and 1996, the gap between the

needs and the energy supplied remains .The Master

Plan proposed that to satisfy demand in Phnom

Penh and these densely populated parts of Cambodia,

a major part of the capacity required be established

in Sihanoukville and capacity for peak demand

be established in Phnom Penh. It also proposed

that up to 30% (80MW) of demand be met through

Power Trade with Vietnam.

Power

Sector Investment Plan Power

Sector Investment Plan |

Indeed The implementation of the Power Sector

Strategy will be a very major undertaking for

Cambodia. It is estimated that total investment

requirements over the period 1999-2016 would total

USD1.2 to us$1.5 billion. For the first 5 years

of the Program (1999-2003), the investment required

is USD400 million, which represents over 10% of

total domestic investment and nearly 3% of GDP.

Concessional finance together with private sector

investment will need to be mobilized.

The Investment Plan comprises (i) the development

of a National Generation and Transmission Grid;

(ii) a Provincial Supplies Rehabilitation Program;

and (iii) a Rural Electrification Strategy and

Implementation Plan.

Private

Sector Participation in the Electric Sector

Development Private

Sector Participation in the Electric Sector

Development |

The Government wishes to encourage private sector

participation in the development of the electricity

sector. A means of achieving this in rural areas

has already been discussed above.

In relation to private sector companies' participation

in providing power to supply the National Grid,

Phnom Penh and provincial towns, a policy is to

be developed to encourage private sector supply

of power at competitive prices. A World Bank sponsored

grant is used to develop guidelines on private

sector participation. It will include guidelines

for competitive tendering by private sector power

producers to supply EDC. As in other countries,

a Model Power Purchase Agreement will be used

for competitive tendering. Policies will also

clearly identify the taxation and investment incentives

that are available for investment in the power

sector.

|

Major

Players in Independent Power Production Major

Players in Independent Power Production |

There are a number of proposed power plants in

Cambodia accounting for hundreds of millions.

They include 320MW and 180MW plants by Siemens

AG, a 12MW plant by Chinese company CETIC,

a 180MW project by Japanese company JICA, and

a 60MW plant by the US company Beacon Hill. Among

those completed and operational are:

Kirirom I

This is the first contract on a BOT basis realized

by the Chinese company CETIC

, in Cambodia. As his General Manager, Mr.

Xiaoming Ou, explains: "Kirirom I comprises

one power plant with two 6 MW turbine units, and

the dam which has been rebuilt. (…) a transmission

line of 115 Kv. with a length of 120 Km to connect

Kirirom with Phnom Penh". Although it was

the first time the company found itself engaged

in such project, the experience has been quite

positive and plans are on their way to start a

second project, Kirirom III, as Mr. Xiaoming Ou

said: "We have formally expressed our desire

to the MIME (Ministry of Industry, Mines &

Energy) to build Kirirom III on a BOT basis. We

are scheduled to start in July or August this

year". This is a slightly bigger project

30 Km. away from Kirirom I, with an 18 MW hydropower

plant. If this project works out as expected,

the Chinese company will most likely start into

even bigger projects in a country that is extremely

rich in water resources.

Oil and

gas sector in Cambodia : "exploring to

fuel the economy" Oil and

gas sector in Cambodia : "exploring to

fuel the economy" |

Cambodia's natural resources, in particular,

the oil and gas sector has remained largely untapped

due to falling prices, internal conflicts and

territorial disputes with neighbouring Thailand.

For H.E. Sok An, Minister in

charge of the council of Ministers "

The CNPA sees the discovery and processing of

oil and gas products within Cambodia as a vital

step in accelerating the country's economic development".

At present, petroleum products for domestic and

industrial use are imported, at an ever-increasing

rate and at great expense, from Singapore, Vietnam

and Thailand

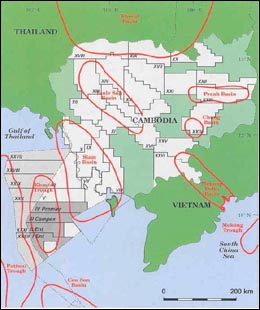

The total estimated reserves in terms of Gas

and Oil plus condensates is about 15TCF (Trillion

Cubic Feet) for the offshore and is located in

different acreages. It is also said that the most

viable and large reservoirs are in the disputed

waters in the Gulf of Siam - the Overlapping Claims

Areas and the inland reservoirs in the Tonle Sap

region.

Along the Overlapping Claims Area, an area estimated

to stretch some 27,000 square kilometers and an

area said to be most viable for commercial exploitation

of oil and gas is currently under negotiations

with the Thai authorities for production sharing

and joint exploration rights. Past exploratory

wells drilled between late 1960s and 1974 when

at least three wells were drilled with mixed results

but said to be largely not commercially viable.

It was only in 1987 that surveys suggested the

existence of an offshore basin - the Khmer Trough,

which bears strong resemblance to the prolific

Patanni Trough and the Malay Basin Province. In

1994, exploration took off to a strong start with

the drilling of four wells again with mixed results

but left unexploited for commercial reasons and

then again in 1998 when Woodside carried out seismic

survey and a reassessment of all previous seismic

data. Woodside relinquished their rights in 1999

and 2000 respectively and the oil and gas activities

went silent again until 2002 when ChevronTexaco-MOECO

signed a production sharing agreement with the

Cambodian National Petroleum Authority in August

2002 and embarked on the drilling of two exploratory

wells in January this year.

As the Director General of the CNPA, H.E. Te

Duong Tara explains: "(…) the CNPA would

be in charge of both aspects of the oil sector,

upstream and downstream. With upstream we mean

all activity starting from day one until you get

production and downstream from wellhead down to

the consumer. (…) we have been assigned a

huge task, and in order to accomplish this task,

we need investment and qualified human resources."

The CNPA is in the process of preparing an Energy

Master Plan to develop the whole energy sector.

The institution, has also drafted the Petroleum

Act that should have to be approved at the end

of this year. Concerning this Act, H.E. Te Duong

Tara said: "(…) the new law is going

to be very comprehensive. (…) I hope this

new law will accommodate everyone as it will be

more flexible and will give more incentive for

the investor to come in. Unlike before, the market

of oil and gas is open, so we have to be more

competitive compared to the neighboring countries

Vietnam and Thailand."

While the oil industry gets on its way, other

companies have known how to establish itself in

the country and provide the current needs by importing

oil. Although several multinational and regional

companies are present in the Cambodian market,

the largest company is Sokimex

Group. Sokimex

( started as a trading firm and has grown to a

giant, the biggest company in Cambodia with almost

50% of the oil distribution and businesses in

other areas like industry and tourism. As his

Vice-Chairman, Oknha Sorn Sokna, explains: "Sokimex

is indeed the first petroleum company of the country

but it is also involved in several other businesses"

MINING

SECTOR MINING

SECTOR |

Cambodia is known worldwide for its rubies, but

there are more mineral resources in the Cambodian

soils proven potential exists for: sapphires,

alluvial, gold, alluvial cassiterite, silica,

manganese, slate, peat, pagodite, phosphate, granite,

limestone, sand, gravel, clay, bauxite, zinc and

copper.

The legal environment for business in the mining

sector is deficient. The Cabinet Council of Ministers

discussed an update of the mining code in August

1995 but no details of possible changes are yet

available. It is envisaged that the mining code

will be complemented by a sub-decree on mining,

which will provide a detailed legal framework

governing the sector.

Government Mineral Exploration Policy: Companies

are offered, during the 1st phase, two to six

years to conduct exploration and a feasibility

study in a designated area. MIME will assist with

technical recommendations and the Cambodia

Development Council (CDC) grants an exploration

license to interested investors.

During the second phase, if exploration is successful,

companies are required to present a master project

plan. CDC grants a mining license to companies.

Royalties and surface rentals are levied on mineral

extraction. When production is profitable, companies

are required to pay income taxes, in addition

to royalties and surface rentals. MIME encourages

two forms of contracts: a production sharing agreement

with a low tax rate, or a concession with a high

tax rate.

|