Economy

and Finance Economy

and Finance |

In the year 2002, the economic situation of Cambodia

reflected the challenges that the Royal Government

of Cambodia had to face: political uncertainty,

Iraqi war and the severe drought and flood that

affected agricultural production, especially rice

and other crops, which account for 15% of GDP.

Macroeconomic

developments Macroeconomic

developments |

In order to ensure economic growth as forecasted,

the RGC launched measures to mitigate the effect

of the drought and it accelerated the mobilization

of local resources and those from bilateral donors

and international financial institutions to continue

the reforms and to accelerate economic and social

development in Cambodia.

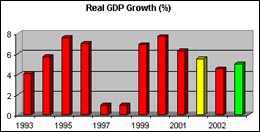

The RGC has continued to develop the implementation

of its economic reform program by realizing a

low inflation and stable economic growth. The

RGC has forecasted that the GDP would increase

5% in 2002, compared to 5.5% projected earlier,

due to the impact of the drought and flood on

agriculture and slower increase in the production

and exports of garment, and the negative effects

of the SARS disease.

The main pillars of growth in 2002 were industry

and service sector. Manufacturing and construction

have been the main drive to sustain growth in

the industrial sector. Garment exports increased

by 22 percent to US$1.3 billion.

The government has pursued "the Locomotive

Strategy" to support development by establishing

a nation-wide road network linking various provinces

to Phnom Penh, the Sihanoukville port and important

border checkpoints; as the Minister

of Finance, H.E. Keat Chhon said: "(…)

we put a strong emphasis on the construction our

infrastructure, particularly the roads. This was

done because opening the country and ease the

flow of goods was the priority in out National

Strategy for Poverty Reduction". This will

create the integration of different parts of Cambodia

into a single market.

This strategy will help reduce transportation

costs and facilitate trade. Infrastructure (road

and bridge) construction financed by concessional

loans from Japan, ADB, WB, other donors and government

budget was on the rise in 2002. The Kizuna Bridge

was inaugurated.

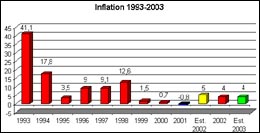

By the end of the 4th quarter of 2002 the inflation

was 3.7% due to the government's continued prudent

budget and monetary policy. The exchange rate

RIEL-USD was broadly stable, around 3.950 Riels.

The current account deficit, excluding transfer,

was -9.4% in 2001 and increased to-9.6% in 2002.

At year-end, the reserve in the banking system

increased from 551 million USD in 2001 to 629

million USD in 2002 covering 3.4 months of imports.

Medium

Term Fiscal Framework Medium

Term Fiscal Framework |

Achieving macroeconomic stability with high economic

growth of 6-7 percent as stated earlier would

require serious actions in implementing the reform

programs and supporting policies. This includes

no monetarization of fiscal deficit, sound financial

system oversight, deepening banking reform, improvements

in revenue, spending increase for social and economic

sector, sound budget and treasury management,

improving investment climate, civil service reform,

legal and judicial reforms.

To this end, actions have been taken to strengthen

tax policy and administration in order to (i)

increase tax revenue, (ii) improve design of the

tax system, (iii) enhance capacity for tax analysis,

(iv) improve administration of the real regime,

(v) improve administration of the estimated regime,

and (vi) expand training and learning in tax administration.

Taxes, defined as taxes as percent of GDP, is

expected to increase from 8.5 percent in 2002

to 8.8 percent by 2005 while non-tax revenue effort

will remain around 3.5 percent from 2002 to 2005.

Overall fiscal revenue as percent of GDP will

grow steadily though slowly from 12.1 percent

in 2002 to 13.9 percent in 2005. It is assumed

that the significant increase in fiscal revenues

in absolute terms will be driven mainly by high

and sustained growth of the Cambodian economy

and implementing reform measures rather than a

dramatic improvement in revenue effort.

As percent of GDP, total expenditure is expected

to increase moderately - from 18.9 percent in

2002 to 19.4 percent in 2005. The planned level

of capital expenditures shows the commitment of

the RGC to invest in physical infrastructure.

Capital expenditures will account for about 7.1-7.8

percent.

Within this frame a blue print for the development

of the financial

and banking sector has been put in place by

the Ministry

of Finance and Economy, this latter shows

the evolution expected of the sector until 2006.

Dollarization Dollarization |

Dollarization emerged as a consequence of low

confidence and a persistent feeling of uncertainty

with regard to the national currency. Cambodia

is a highly but not a 'fully' dollarized economy.

The government, through the MEF still remains

the core institution that injects riel into circulation.

Dollarization has provided both benefits and drawbacks

for economic development and poverty reduction.

Partial dollarization has imposed some discipline

on fiscal operations, and the commitments of the

government to establish political and macroeconomic

stability were and remain a crucial factor for

a reform program to be a success. It is also in

this context that both the autonomy of the central

bank in carrying out its functions and the accompanying

accountability must be recognized.

There is limited room for fiscal adjustment because

dollarization puts constraint on the mechanism

of deficit financing other than external debt

or assistance or domestic borrowing at market-determined

interest rate. In other words, dollarization may

deprive fiscal benefit that can occur when the

government runs a fiscal deficit through the central

bank's expansion of money supply.

Monetary

Developments Monetary

Developments |

The principal mission of the National Bank of

Cambodia (NBC) is to determine and direct the

monetary policy with the aim of maintaining price

stability in order to facilitate economic development

within the framework of the economic and development

policy. Prudent monetary policy and fiscal discipline

have been successful in achieving and maintaining

macroeconomic stability with low inflation (5%).

|

Since the end of 2000, claims on the government

by the banking sector have been virtually eliminated.

Credit from the central bank to the remainder

of the banking system remains absent. The NBC

has constantly accumulated its international reserves.

Growth in the country's gross international reserves

has kept pace with the continuous increase in

total imports of goods and services and reached

more than three months cover in recent years.

Inflation has been kept within the target and

in fact turned negative during recent period,

while the value of the riel has largely been stabilized.

Concerning the current state of the banking system,

the liquid asset ratio is close to 60%. However,

due to the fact that a large proportion of bank

assets are held in low yielding assets, the profitability

of the banking sector is low.

The new

banking systems The new

banking systems |

As the Governor of NBC, H.E. Chea Chanto explained,

the main component of the Law on Banking and financial

institutions passed in 1999 "was the requirement

of a minimum capital (USD 13 million) to the banks

and the imposition to provide the legal basis

for supervision". Before the re-licensing,

there were more than 30 commercial banks. Presently,

there are thus only 17, operating in the country

from which two are state-owned.

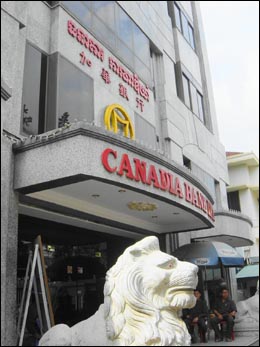

One of them, the Canadia

Bank Ltd, founded by Pung Kheav Se, has in

deposits 26% of the whole country's desposits

and its loans are about 32% of country's total.

It is also the first commercial bank in Cambodia

to use the smart card system and it was chosen

by the Ministry

of Economy and Finance to run a small and

medium enterprise project with KfW, a German financial

institution. Actually, as the President of Canadia

Bank, Pung

Kheav Se underlined "The problem you

encounter in Cambodia is that if you deposit 1

million, 48% to 52% of it must remain in the bank...

So, our target is to find foreign financial institutions

to have long-term local funds for economic development"

and he added that the loan interest now is 12%

and "This is very hard for local businessmen,

we have to reduce the interest rate".

There is also an Association of banks in Cambodia,

which currently has 23 members, consisting of

local and foreign banks. "We began to organize

ourselves in 1994 and are now fully recognized

under the banking Act" explained its President,

Khov

Boun Chhay, who is also President and Chief

executive officer of the MekongBank.

The chief functions are to share information among

members, to participate in joint activities such

as training and to act as a single voice for the

industry in dealing with the public and the Royal

government. They are also members of the ASEAN

Bankers Association "which has been of great

benefit to individual banks and to the Cambodian

banking system as a whole".

MekongBank,

have also the ambition to become a leader in the

region and worldwide, and began to establish many

strategic partnership through the world, linking

thus the Cambodian Banking sector to many relevant

international actors, as its president Khov Boun

Chhay explains us; "We have established correspondent

relations with major international banks in Europe,

Asia and the United States. For example, through

our principle international correspondent and

strategic partner, ABN-AMRO Bank, we have access

to their global network of over 3,500 locations

in 76 countries. Another critical element in MekongBank's

international policy involves the establishment

of strategic alliances with key financial institutions

throughout the region."

An other major locally based bank, the SBC

(Singapore

Banking Corporation) (http://www.sbc-bank.com)

Bank, it is investing in a VISA credit card system

and as underlined his President, Andy Kun, "It's

going to be the first in Indochina and one of

the few in Southeast Asia to issue an EMV chip-based

credit card". All this initiatives mark clearly

the dynamism of the sector, which will be crucial

for the development of the local economy.

In order to implement the economical reconstruction

of the country, NBC and IMF have mainly a stabilization

program called Poverty reduction and growth facility,

involving around USD 84 million. With the Asian

Development Bank (ADB), NBC works closely on the

formulation of a long term plan development. The

ADB, which has also provided the technical assistance

to strengthen the micro finance supervision, the

AFD (Agence Française de développement)

collaborates in the field of strengthening micro-finance

institutions, especially providing the small credit

to farmers in the rural area.

The strengthening of the financial sector is

also a priority of the Minister

of Finance and Economy: "The financial

sector is of course of strategic importance (…)

This includes the development of our banking and

insurance system as well as our leasing, capital

markets and other financial products systems".

Concerning the creation of the Cambodian Stock

Exchange, NBC's board has set a list of priorities.

The first one is to strengthen the banking sector

to introduce a sound accounting system in the

whole country, but the Governor doesn't expect

the creation before 2008-2010.

|