Presentation Presentation |

Joint Commercial Bank "Eridan" started

operating on 29 November 1996 (General license of

NBKR 36 of 29 November 1996). In August 2001, as

a result of planned increase of the charter capital,

the new share holders joined the bank and took the

decision to rename JCB "Eridan" into JSC

"INEXIMBANK" in order to mark their joint

venture and fully reflect the sphere of the bank

activity.

History

of INEXIMBANK History

of INEXIMBANK |

In 1996, the bank started with the charter capital

of 10 M som (800 thousand US dollars) and actively

participated in practically all spheres of activities

provided by the legislation for financial and credit

institutions of the Kyrgyz Republic. At the same

time, the bank adhered to the conservative policy

of risk management and provided the services which

satisfy the clients needs. One of the important

achievements in the activities of the bank was the

increase of the charter capital by 31 December 1997

up to 30 M som. In 1997, the assets of the bank

increased, from 10.2 M som to 69 M som, the credit

portfolio of the bank was 44.9 M som, allowing the

bank to get the net profit of 7.6 M som. The interest

income equalled 13.2 M som.

The bank has always paid special attention to the

issue of increasing the capital. As of January the

1st, 1999, the charter capital was 34.7 M som, and

by 1.04.99 it reached 50 M som thanks to the distribution

of the profit in 1998 and additional investment

of the share-holders assets. In 1998, the bank assets

increased and equalled 103 M som, the credit portfolio

was 71 M som. As a result there was an increased

net profit of 14 M soms, and the interest income

reached 30.5 M som.

In 1999, we witnessed the reduction of the bank

assets growth rate, reasons being, the difficult

situation in the economy of the Republic. The

financial crisis in Russia had a negative impact

on the banks activities and their clients. In

the Republic, a number of strategically important

fuel companies went bankrupt. These companies

were among the leading clients of the bank and

their bankruptcy brought losses to the bank. The

bank lost 4.6 M som as a result of the creation

of reserves to cover credit losses. Nevertheless,

the bank increased the assets by 10% up to 114.4

M som, the credit portfolio made up 62 M som.

The interest income equalled 27 M som. In spite

of all negative tendencies, in November the bank

became one of several banks which signed the Subsidiary

Agreement with NBKR for serving the credit line

of the International Association of Development

(IDA) by 01.09.02 the credits given totalled US

$800 000. That very year, the bank was the first

to sign the Agreement with Central American Fund

for Entrepreneurial Support to serve the credit

line. In 1999, the bank joined the international

system Western Union, which allowed making payments

and transferring money without opening an account.

This, undoubtedly, was a big achievement for the

bank, which brought its own advantages.

For the Bank, the year 2000 represented overcoming

negative tendencies of the previous year. The

bank assets increased up to 160.646 M some, the

credit portfolio was 98.9 M som. The net profit

increased by 223% and made up 4 M som, the interest

income equalled 25.9 M some. On 21 November 2000

the bank signed an agreement with EBRD for serving

the credit line. At the end of the year, another

project ¨Trade Promotion¨ was started

with EBRD. The main task of the program is the

promotion of trade deals, by providing different

payment mechanisms for the banks clients.

2001 was the year of further growth and increase

of operations. The bank assets reached 189 M som,

the credit portfolio made up 149.3 M som, the

interest income - 30.9 M som, net profit - 17

M som.

Currently Ineximbank is a universal bank, which

provides a wide spectrum of services for their

clients and has the charter capital of 100 M som.

Joint Stock Bank "Ineximbank" is the

first bank in Kyrgyz tan, with which EBRD signed

the agreement for the development of crediting

small and micro-enterprises in the Kyrgyz Republic.

On 8 July 2002, the credit agreement was signed

and by 01.09.02 the credits given totalled US

$192.508.

Partners Partners |

In order to provide export-import operations

for the clients, correspondent ties were established

with the following banks: Auto bank, Alfa bank,

Promsvyazbank (Russia), Riggs Bank (USA), Deutsche

Bank AG, Dresdner Bank (Germany), ING Bank (Austria),

CCF (France), Credit Agricole Indosuez (Switzerland),

Thaieximbank (Thailand), Alma-Tay Trading-Financial

Bank, People.s Bank, Bank Centre Credit (Kazakhstan),

and other.

INEXIMBANK

in numbers INEXIMBANK

in numbers |

Evolution of Assets in Millions

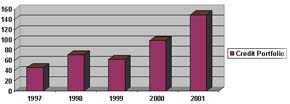

Evolution of Credit Portfolio in Millions

|

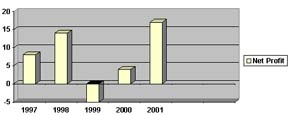

Evolution of Net Profit in Millions

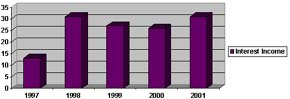

Evolution of Interest Income in Millions

Products Products |

Credit Cards

Plastic, bank, payment, club, discount, identification,

embossed, non-embossed, credit, debit, ATM, magnet,

smart, individual, corporative, family, VISA,

MasterCard, American Express, Diner Club, standard,

gold, electronic - these and many other words

are used together with the word card.

Payment cards is a modern mean of payment which

allows:

· To use the international payment system

(pay without commissions for goods and services),

· To collect the cash through the global

network of cash dispensers and ATM (automated

teller machine),

· To pay for goods and services through

internet,

· Not to declare the funds allocated on

the account of payment card when going abroad,

· Safety of the card account is provided

by PIN-Code which is only known by the card holder.

At the end of 1998, the bank joined the payment

system of VISA International. INEXIMBANK serves

international payment cards VISA (Classic, Business,

Gold, Electron and e-c@card), EuroCard/MasterCard

(Standard, Business, Gold), Cirrus/ Maestro.

Western Union

Money transfer on Western Union System can be

dispatched or collected in INEXIMBANK at the head

office or in the savings bank at

105, Sovietskaya Str.

+996 312 651 532

+996 312 600 345

Payment

Money transfer is paid in cash, cheque or their

combination in accordance with the tariffs.

Additional services

There is an additional payment for these services.

The beneficiary can be notified of the money transfer

in his name by phone. The cheque can also be delivered

to the indicated address. The money transfer can

be supplemented with additional information.

TARIFFS for remitting the money transfers

(in USD)

Amount Tariff

50,00 or less 13,00

50,01-100,00 15,00

100,01-200,0 22,00

200,01-300,00 29,00

300,01-400,00 34,00

400,01-500,00 40,00

500,01-750,00 45,00

750,01-1000,00 50,00

1000,01-1500,00 75,00

1500,01-1750,00 80,00

1750,01-2000,00 90,00

2000,01-2500,00 110,00

2500,01-3000,00 120,00

For the amount of money more than $3000, $ 20

is added for each $500.

Full information on money transfer by Western

Union System is available from Monday till Friday,

8-00 to 17-00 by telephone: 651538 in INEXIMBANK

or on Western Union website.

Traveller's cheques

Traveller's cheque is a payment document resembling

a banknote. This is not only external similarity:

the cheque has its nominal value and number and

is issued in basic types of currencies as well.

· Convenience in payments

· Reliability and safety of keeping the

funds

· Reimbursement of funds in case of the

cheque loss

· Unlimited validity period of the traveller's

cheque

Traveller's cheque is a convenient form of payments

and keeping monetary funds accepted worldwide.

If you are going for a business or tourist trip

abroad, use the traveller's cheque.

In many countries the traveller's cheques are

accepted for payment in shops, restaurants, hotels,

services, etc. If you want to cash the cheques,

it can be done in banks.

Traveller's cheques do not have the validity

period. If you didn't use the traveller's cheque

during the trip you could use them some next time.

In case you lose your traveller's cheque you'll

be refunded the amount in foreign currency or

in traveller's cheques.

Traveller's cheques have high degree of protection

(e.g. Thomas Cook cheques have 17 degrees of protection).

All these precautions practically fully exclude

the possibility of using traveller's cheques by

criminals. Ineximbank cashes traveller's cheque

of Thomas Cook, Visa international, CITICORP,

American Express companies. You can get an additional

information from Monday till Friday, 8.00 to 17.00

by telephone in Ineximbank: 651538.

|