INTRODUCTION INTRODUCTION |

An air of excitement has descended on the tropical

island of Fiji in the Pacific and it is not only

because the country will be hosting the region's

12th South

Pacific Games in June this year. While the bringing

together of 5,000 athletes and officials at a games

budget and investment that is running into $100

million FJD (@ $50m USD), there are other reasons

for the feeling of enthusiasm and optimism in this

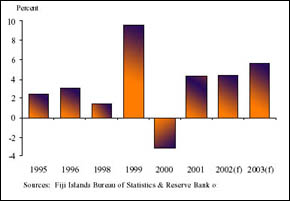

island nation. After an impressive economic growth

rate of 4.4 percent in 2002, the country is now

bracing for an almost 6 percent growth for 2003.

To achieve this, the Fiji government, which is being

led by a former banker as Prime Minister, intends

to raise investment levels from the current low

of 11 percent to 25 percent of its Gross Domestic

Product.

Fiji,

Back In Business Investment in this South Pacific

nation has been lethargic at best. To show its seriousness

in achieving its targeted growth, the government

has been investing heavily in capital development.

For 2003 alone, this amounted to $240 million FJD

(@ $120m USD), some 20 percent of its total expenditure.

Now the private sector is taking up the cue with

the powerful employers' bloc, the Fiji Employers

Federation, estimating proposed investment in Fiji

at about $1 billion FJD (@ $500m USD). Such an ambitious

plan is a far cry from the severe battering the

Fiji economy had suffered from three coups, two

in 1987 and another in 2000. Investors fled in droves

and the country's professionals followed, emigrating

in worrying numbers, mainly to Australia, New Zealand

and North America. Fiji,

Back In Business Investment in this South Pacific

nation has been lethargic at best. To show its seriousness

in achieving its targeted growth, the government

has been investing heavily in capital development.

For 2003 alone, this amounted to $240 million FJD

(@ $120m USD), some 20 percent of its total expenditure.

Now the private sector is taking up the cue with

the powerful employers' bloc, the Fiji Employers

Federation, estimating proposed investment in Fiji

at about $1 billion FJD (@ $500m USD). Such an ambitious

plan is a far cry from the severe battering the

Fiji economy had suffered from three coups, two

in 1987 and another in 2000. Investors fled in droves

and the country's professionals followed, emigrating

in worrying numbers, mainly to Australia, New Zealand

and North America.

But Prime

Minister Laisenia Qarase and his government

believe the negative trend has been arrested and

figures are beginning to show a turnaround. Prime

Minister Qarase believes the policies his government

have put in place are pro-investors and the climate

to invest in Fiji has never been better. "The

Foreign Investment Act that became law a few years

back has some deficiencies and we have taken the

opportunity to review it so that we strengthen the

legislation with the aim of attracting more and

more FDI into the country," says Qarase.

"Our 2003 Budget is pro business but it

is also pro poor and pro rural. There is a lot in

the budget to strengthen the business sector but

there are also a lot of programmes that work towards

alleviating poverty."

Savenaca Narube,

Governor of the Reserve Bank

of Fiji was among those that drew up an economic

recovery plan. Fiji, he said, was never in any threat

of a financial crisis during and after the coup,

which would normally be the sequence of events in

such a crisis. "When a political crisis

happens the next thing you see is a financial crunch,

and that never happened here. That is the best message

we could send to safeguard financial stability,"

Narube explains. Fiji's

Foreign and External Trade Minister, Kaliopate Tavola,

explains the current situation: "The economy

now is almost 100% recovered. We have maintained

financial stability and the figures for economic

growth are looking very promising. We are looking

at a 5% or 6% this year and another positive growth

in the year 2004". Explaining how the turnaround

came about, the head of the Fiji

Trade and Investment Bureau, the trade and investment

agency of government, Jesoni

Vitusagavulu says a lot of the Bureau's

efforts were about testifying that Fiji had a good

record bouncing back very strongly after a political

turmoil. "If you look at this country's

economic record you will realise that some of the

best economic performances in Fiji's independent

history took place during the five-year period after

1987. This shows the relative resilience of our

economy," Vitusagavulu said. |

The

feeling of optimism in this island nation is evident

despite the pending result of an important court

decision at which the legality of the Fiji Government

is being questioned. Fiji's independent Supreme

Court presided by a panel of overseas judges will

in June hear and rule on an appeal by Prime Minister

Qarase: that two lower courts erred in law in declaring

his cabinet unconstitutional. The plaintiff is Qarase's

predecessor, Mahendra Chaudhry and leader of the

second largest party in parliament, the Fiji Labour

Party. At issue is the multi-party cabinet provision

of Fiji's constitution, which Qarase has labelled

as impractical and unrealistic. He has however given

the assurance that his government will deem the

pending Supreme Court decision as final and will

abide by it. The

feeling of optimism in this island nation is evident

despite the pending result of an important court

decision at which the legality of the Fiji Government

is being questioned. Fiji's independent Supreme

Court presided by a panel of overseas judges will

in June hear and rule on an appeal by Prime Minister

Qarase: that two lower courts erred in law in declaring

his cabinet unconstitutional. The plaintiff is Qarase's

predecessor, Mahendra Chaudhry and leader of the

second largest party in parliament, the Fiji Labour

Party. At issue is the multi-party cabinet provision

of Fiji's constitution, which Qarase has labelled

as impractical and unrealistic. He has however given

the assurance that his government will deem the

pending Supreme Court decision as final and will

abide by it.

Shedding Bureaucracies Through Corporatisation.The

Fiji Government has a public sector reform programme

that has seen a number of selected public enterprises

undergone corporatisation and privatisation. The

programme has seen government bodies being turned

into public companies. Telecom Fiji and Post Fiji

are case in point as well as Airports Fiji Limited,

Ports Terminal Limited, Land Transport Authority,

Fiji Hardwood Limited and Fiji Pine Limited. Some

of these companies have quickly learnt the ropes,

of the new way of doing business and being customer

and service oriented. Quite a number have developed

into multi-million dollar businesses, helped in

no small measure of course by the exclusive licence

they have negotiated for themselves. This is especially

true for Telecom Fiji, Post Fiji, Airports Fiji

Limited and Land Transport Authority. The financial

performance of enterprises monitored by the ministry

of Public Enterprises has improved steadily. They

made a combined Net Profit after Tax of $11.7 million

FJD in 2001. They paid taxes of $1.6 million FJD

in 2000 and $1.7 million FJD in 2001 and also paid

dividends of $1.6 million FJD in 2000 and $1.9 million

FJD in 2001. The reform objectives are to ensure

the efficiency of the enterprises and because of

their strategic importance they contribute directly

to the cost of doing business in Fiji. Mr.

Irami Matairavula, Minister for Public Enterprises

and Public Sector Reform says that "the

efficiency of the Ports and Airports, availability

of air freight cargo spaces, effective water and

power supplies as well as the overall standard of

infrastructure in the country are some of the fundamentals

for increased investment." Concerning the

Government policy on the privatization of national

strategic assets, Matairavula says Qarase's cabinet

"considers privatization cautiously and

Parliamentary approval is required. Nevertheless,

foreign participation as strategic partners in our

enterprises will be always welcomed as they bring

in technical and management expertise required to

improve operations of the enterprises as well as

the finance to adequately capitalize them."

The country's international carrier Air Pacific

has undergone a successful privatisation exercise.

Australian airline QANTAS now owns 46 percent shares

in the company. Previous governments had expressed

their interests in injecting the corporate culture

in other industries like power, water, printing

and government supplies.

|