INTRODUCTION - RUSSIA'S GLOBAL INTEGRATION

INTRODUCTION - RUSSIA'S GLOBAL INTEGRATION |

Remember 1998 and the days of Russia's economic

and financial meltdown? Well, have a look at Russia

under Vladimir Putin, because those days of economic

and financial anarchy are well and truly gone. Indeed,

Russia is starting to prove that the clichés

about its economy and society do not necessarily

resonate in its reality.

President Vladimir Putin

Prime Minister

Kasyanov sees "the normalization of public

life and the step-by-step restoration of the middle

class, which suffered most during the financial

crisis of 1998. Stability at last has firmly settled

in Russia." There is a clear improvement

of economic conditions, industrial growth, and

a profitable state budget - figures that are positively

perceived by Russian citizens.

The 1998 rouble crisis is now nearly five long

years away and businesses in some sectors - notably

IT and consulting, but also oil - have even come

to the conclusion that the crisis offered an opportunity.

Russia's increasingly stable economic prosperity

saw an increase of GDP in 2002 by more than 4%

on the previous year to around $11 billion. There

was a budget surplus nearing $7 billion, or some

2% of GDP, and inflation dropped. A major challenge

will be to pass through the years 2003-2005 as

these will be tough years considering Russia's

debt commitments. The government hereby aims for

an annual growth of 4 to 6% of GDP. Promisingly,

there are an extra $11.3 billion of gold and foreign

currency reserves, which the Central Bank expects,

with the help of oil, to total $55 billion by

the end of 2003. Indeed, the Russian Federation

is, albeit very gradually, paying off its debt

to the IMF ahead of schedule and expects to pay

back some $2 billion by the end of 2003.

Russia is looking increasingly favourable to for

example American investors. For example, the Russian-American

Business Dialog that was instigated in 2001 has

been strongly endorses by the Russian and American

Presidents and has already become a major force

influencing decision making in bilateral relations,

says Prime Minister Kasyanov. As pointed out by

Andrew B. Somers,

President of the American Chamber of Commerce

in Russia (AMCHAM), Coca

Cola, Pepsi Cola, Procter & Gamble, Gillette,

Kodak, Cisco, IBM, Microsoft, Intel and GE are

all in Russia making money. He emphasised that

"In fact, these American companies are doing

extremely well in Russia; sales growth in 2000

compared to 1999 was in double and triple digit

figures, and the same is true for 2001 over 2000"

and the trend continued in 2002.

Also from a trading point of view Russia is leaping

forward. The state of Russia's economy was not

up to scratch in 1998, which caused a trade deficit

with the trade balance reduced to a critical level

of $2 billion. Times have changed indeed. Russia's

foreign trade balance was positive at $59.8 billion

in 2002, an increase of $1.7 billion compared

to 2001. Exports rose 9.8 percent against 2001,

totalling $105.8 billion. The European Union countries,

led by Germany, accounted for 36.6 percent. Russia

is now a fully fledged member of the G-8 group

of countries, has been awarded market economy

status by the European Union and the United States,

and is well on its way to becoming a member of

the World Trade Organisation (WTO).

|

Promisingly, there is

a growing awareness in Russia that economic methods

of regulating foreign trade are more effective than

administrative ones. Vital for the future of Russia

is the making of a new customs law that is planned

for implementation in July 2003. The code was prepared

by the States Customs Committee, the Ministry of

Economic Development and the expertise of the EU

and the WTO. Mikhail Vanin,

Chairman of the State Customs Committee of the Russian

Federation, stresses that "This new code envisages

new customs regimes used internationally to develop

industry and investments. This new customs regime

includes transforming goods in order to add new

value to them under customs control (for there not

to be duties when they are re-exported), leasing,

or temporary import."

There are still many issues which need to be addressed

before the Russian Federation is accepted into the

WTO but progress is being made: "the speed

we are moving at is different from one issue to

the other", says Maksim

Medvedkov, Deputy Minister for Economic Development

and Trade, "we have started real discussions

on systemic issues which will be included in the

so called Protocol of Accession (and) I believe

that we could complete this process rather rapidly,

provided that all the factors are realistic."

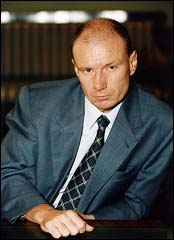

Vladimir Potanin - CEO of the Interros Holding

Vladimir Potanin, one-time oligarch and nouveau-philanthropist,

believes the most important aspect of the process

is to carefully consider Russia's aims in joining

the WTO. According to the wildly successful

CEO of the Interros Holding, which harbours

companies such as Norilsk Nickel, the world's

largest nickel and palladium producer, "The

real question is whether WTO entrance is the target

or the instrument. In my opinion, it is not a

target in itself, it is an instrument to becoming

more integrated in the global economy and adapting

to world standards."

Encouragingly, Alexei Mordashov,

President of the powerful Severstal group and

as the head of the working Group of Russian Union

of Industrialists and Entrepreneurs (RSPP) that

deals with the WTO, "...can see that the

business representatives are ready to discuss

WTO entrance not only from the point of view of

claiming something from the state, but also considering

their own faults and the ways of increasing competitiveness

and exchanging experience."

Leading Russian entrepreneurs are under no illusions,

however: "only healthy branches of the economy

and only the most competitive enterprises are

going to survive", says Mr Potanin. Still,

there is, according to the Prime Minister: "also

good news - even the most popular Russian assets

still look incredibly cheap by any standard or

benchmark. Not to mention numerous Russian investment

opportunities which are currently not well known

to the general investment community." For

example, Anna Belova,

Deputy Minister for Railways, draws the attention

to the reform of the Russian railway system. A

reform plan aims to raise the share of freight

transported by private operators in Russia to

50%. The share is currently 10%. Some estimates

put total investment needed to upgrade the Russian

rail system at $22-25 billion. The first stage

of the reform process has been planned for completion

by April 2003 when the ministry's commercial and

regulative functions are split up and the joint

stock company Russian Railways is created. These

and many other Russian investment opportunities

can be exploited and not in the very long run.

|